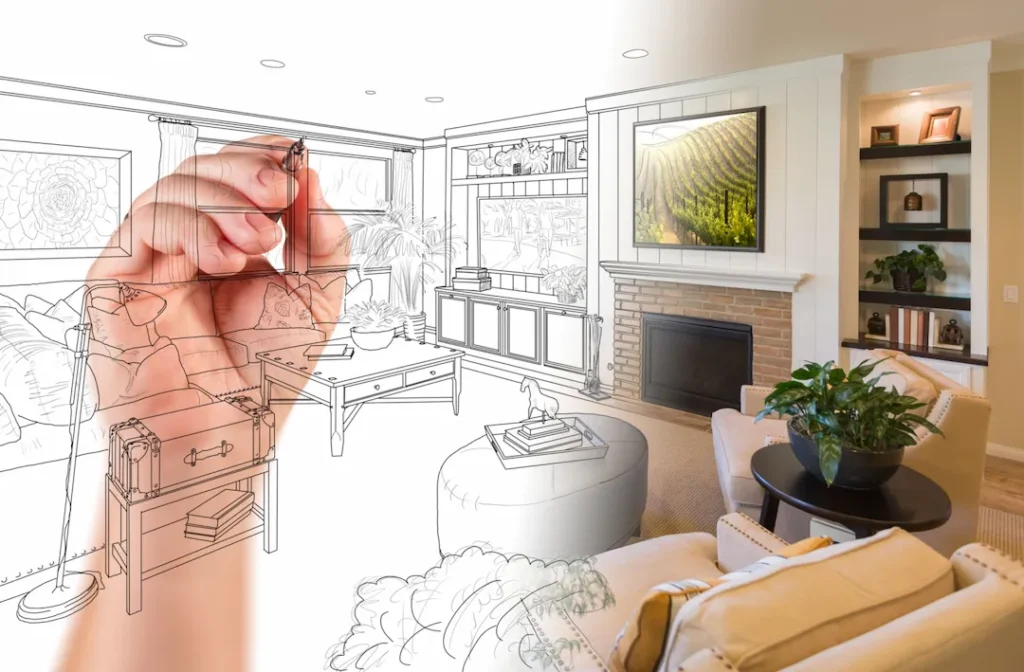

Planning a home remodel is exciting — until costs start adding up. A home renovation mortgage can be the smartest way to finance your remodel because it lets you fund upgrades and improvements without draining your savings. Instead of taking multiple loans or relying on credit cards, you can use a mortgage designed specifically for improvement projects. This type of financing combines renovation costs with your home loan, giving you a simplified payment structure and usually a lower interest rate than personal loans.

If you’ve been Googling how to pay for your remodel, researching lenders, or trying to understand terms like home renovation loan, renovation financing, and home equity loan vs renovation mortgage, this guide will break everything down in simple language — with real examples and expert tips.

Content

What Is a Home Renovation Mortgage?

A home renovation mortgage allows homeowners to finance both the property and the cost of improvements within one mortgage. Instead of waiting years to save money or using high-interest credit cards, you spread the renovation cost across your mortgage term.

Think of it as a two-in-one solution:

? Buy (or refinance) the house

? Include renovation costs in the mortgage amount

How Does a Home Renovation Mortgage Work?

Here’s how lenders typically process renovation mortgages:

- A contractor estimates the total cost of improvements.

- The lender appraises the future value of the home after renovations.

- Loan funds are released in multiple stages as work progresses.

Many people ask: “can you add renovation costs to a mortgage?”

Yes — that’s exactly the goal of a home renovation mortgage. Instead of multiple financing lines, it’s rolled into one loan.

Popular Mortgage Options for Home Renovation

There are multiple options, depending on your situation:

1. Renovation Mortgage (single combined loan)

This is ideal if you’re planning a major remodel — kitchen upgrade, adding rooms, roof replacement, etc.

Why it works:

- Combines purchase or refinance + renovation cost

- Fixed loan terms and predictable payments

2. Home Equity Loan (uses your current equity)

If you already have a mortgage and don’t want to refinance, consider tapping into existing equity.

Comparison insight many homeowners ask about:

home equity loan vs renovation mortgage —

- A home equity loan works best for smaller projects and when you want to keep your existing mortgage terms.

- A renovation mortgage is better for major upgrades and when refinancing could lower your interest rate.

3. Home Remodeling Finance Options via Government or Banks

Some lenders offer specific home remodeling finance options such as:

- FHA 203(k) Renovation Loans

- VA Renovation Loans

- Fannie Mae HomeStyle® Loans

These options are helpful when credit isn’t perfect — approvals are based on the future appraised value of your home.

Case Study: How Christine Increased Her Home Value Using a Renovation Mortgage

Real homeowner experience — simplified for learning.

Meet Christine.

He bought a home in an excellent neighborhood, but it needed a modern kitchen and new flooring. The renovation quotes totaled $55,000. She didn’t want to drain her savings or use high-interest personal loans.

She applied for a home renovation mortgage instead.

Here’s what happened:

- Her mortgage included purchase price + $55,000 renovation costs.

- Funds were released to contractors in stages.

- After renovations, her home value increased by $90,000 within six months.

Result:

One loan, one payment — and a massive equity boost.

Christine told me,

“If I had used a personal loan, I would’ve paid thousands more in interest. Combining it with my mortgage was the smartest move.”

What Are the Requirements?

Most lenders will ask for:

- Proof of income (bank statements or payslips)

- Improvement plan or contractor quote

- Credit score qualification (varies by lender)

- Appraisal based on future value

The more detailed your plan, the better your approval chance. If you search online for home renovation mortgage requirements, this is exactly what lenders look at.

Best Practices Before Applying

Get 2–3 contractor quotes

Avoid choosing trendy renovations that don’t add value

Keep a contingency budget (10–15%)

One key success tip: prioritize renovations that increase property value, such as:

- Kitchen upgrade

- Bathroom remodel

- Flooring

- Roofing or windows

When Should You Choose a Home Renovation Mortgage?

Choose it when:

- You’re buying a home that needs repairs

- You want to refinance AND renovate

- You want one loan instead of multiple financing sources

Avoid it when:

- Your renovations are minor (less than $15,000)

- You don’t want to refinance your current mortgage

Pros and Cons

| Pros | Cons |

|---|---|

| Low-interest rate vs personal loans | Requires lender approval on renovation plans |

| Increase home value & build equity | Paperwork may feel overwhelming at first |

| One monthly payment only | Contractor payments are released in stages |

Final Thoughts

A home renovation mortgage is more than just a financing strategy — it’s an investment in increasing your home’s market value. By leveraging renovation financing the smart way, you avoid unnecessary high-interest debt and keep your budget stable.

Whether you’re modernizing your kitchen, adding a room, or updating your exterior — the right financing approach can turn your renovation goals into reality without financial stress.

FAQs

Is a home renovation mortgage only for buying fixer-upper homes?

No. You can use a home renovation mortgage for both buying a fixer-upper and renovating your current home through refinancing.

Do renovation mortgage funds go directly to the homeowner?

No. In most cases, the lender releases renovation funds directly to contractors in stages (called “draws”) to ensure work is progressing as planned.

Can I use a renovation mortgage to DIY the renovation myself?

Some lenders allow DIY work, but only for smaller projects. Major structural work (roofing, plumbing, electrical, etc.) must be done by a licensed contractor for loan approval.

How long does a renovation mortgage approval take?

Approval time varies, but most renovation mortgages take 30–45 days because the lender needs contractor quotes, project plans, and appraisals based on future home value.

Christine Kelley is a dedicated home blogger who has been blogging for over six years. She covers everything home related. Christine also loves writing posts about her travels to Europe with her husband and two children.